Investors Financial Information

Numbers in Focus and Review

| (in RM million) | FY2025 | FY2024 | FY2023 | FY2022 | FY2021 |

|---|---|---|---|---|---|

| Revenue | 11,334.7 | 9,603.6 | 11,583.8 | 15,578.7 | 11,251.7 |

| Profit before Interest and Tax (PBIT) | 1,700.6 | 1,535.3 | 1,815.5 | 2,494.2 | 1,747.5 |

| Shareholders' Equity | 12,294.0 | 11,678.6 | 11,330.8 | 10,943.7 | 10,005.4 |

Our Revenue, PBIT and

Shareholders' Equity

Revenue

Profit before Interest and Tax (PBIT)

Shareholders' Equity

FFB, CPO and Palm Kernel Production Over The Months

CPO (MT)

Palm Kernel (MT)

FFB (MT)

Oil & FFB Yields

Oil Yields

FFB Yield Per Mature Hectare

Crop Statement of Oil Palm

| FY2025 | FY2024 | FY2023 | FY2022 | FY2021 | |

|---|---|---|---|---|---|

| Average mature area harvested (hectare) | 138,597 | 144,959 | 143,996 | 141,011 | 140,418 |

| FFB production (metric tonnes) | 2,839,583 | 2,803,965 | 2,686,356 | 2,726,516 | 2,917,621 |

| FFB yield per mature hectare (metric tonnes/hectare) | 20.49 | 19.34 | 18.66 | 19.34 | 20.78 |

| Mill production (metric tonnes) | |||||

| Crude palm oil | 616,307 | 625,127 | 580,688 | 607,200 | 646,692 |

| Palm kernel | 106,914 | 112,059 | 114,818 | 124,114 | 135,853 |

| Oil extraction rate (%) | |||||

| Crude palm oil | 21.33 | 21.77 | 20.92 | 21.39 | 21.39 |

| Palm kernel | 3.70 | 3.90 | 4.14 | 4.37 | 4.49 |

| Average selling price (RM/metric tonnes) | |||||

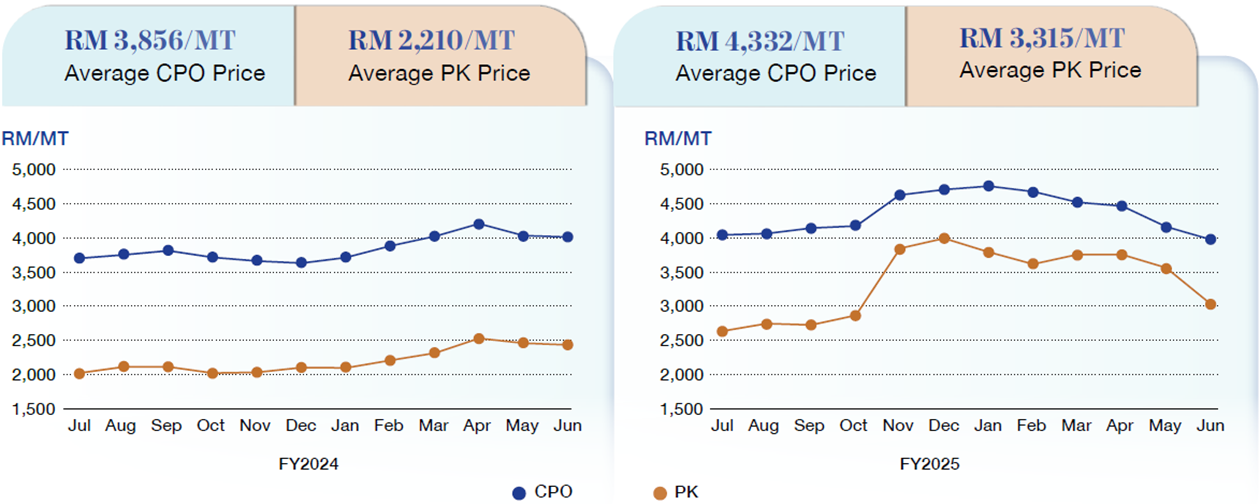

| Crude palm oil | 4,332 | 3,856 | 4,118 | 4,688 | 3,076 |

| Palm kernel | 3,315 | 2,210 | 2,233 | 3,593 | 2,115 |

Area Statement

| FY2025 | FY2024 | FY2023 | FY2022 | FY2021 | |

|---|---|---|---|---|---|

| OIL PALM | |||||

| Mature | 135,423 | 147,152 | 146,069 | 143,787 | 143,749 |

| Immature | 32,460 | 24,955 | 27,749 | 31,405 | 33,177 |

| Subtotal | 167,883 | 172,107 | 173,818 | 175,192 | 176,926 |

| COCONUT | |||||

| Mature | 494 | 249 | 249 | 54 | 54 |

| Immature | 3,122 | 2,882 | 1,921 | 909 | 236 |

| Subtotal | 3,616 | 3,131 | 2,170 | 963 | 290 |

| Others | 960 | 964 | 937 | 825 | 889 |

| Total planted area | 172,459 | 176,202 | 176,925 | 176,980 | 178,105 |

| Nursery | 334 | 338 | 358 | 324 | 254 |

| Estate under development | 381 | 378 | 462 | 532 | 554 |

| Building sites, labour lines, roads and others | 32,528 | 28,155 | 29,384 | 29,277 | 28,074 |

Plantation Statistics

Crop Mix

Crop Mix

172,459 Ha

Total Planted Area

97%

2%

1%

As of 30 June 2025

Oil Palm

Coconut

Others

*Other crops are negligible.

Oil Palm Hectarage by Age

Group

167,883 Ha

Total Oil Palm Planted Area

21%

45%

15%

19%

Malaysia

146,506 Ha

Total Oil Palm Planted Area

24%

39%

16%

21%

Indonesia

21,377 Ha

Total Oil Palm Planted Area

83%

8%

9%

As of 30 June 2025

Past Prime

Prime

Young

Immature

Oil Palm Hectarage by Region

East Malaysia

64%

107,055 Ha

Total Oil Palm Area

75%

79,795 Ha

25%

27,260 Ha

Peninsular Malaysia

23%

39,451 Ha

Total Oil Palm Area

91%

36,078 Ha

9%

3,373 Ha

Indonesia

13%

21,377 Ha

Total Oil Palm Area

91%

19,550 Ha

9%

1,827 Ha

As of 30 June 2025

Mature

Immature

Average Realised CPO and PK Prices

| In RM million unless otherwise stated | 2025 | 2024 | 2023 | 2022 | 2021 |

|---|---|---|---|---|---|

| RESULTS | |||||

| Revenue | 11,334.7 | 9,603.60 | 11,583.80 | 15,578.70 | 11,251.70 |

| Profit before interest and tax | 1,700.6 | 1,535.30 | 1,815.50 | 2,494.20 | 1,747.50 |

| Net foreign currency translation gain/(loss) on foreign currency denominated borrowings and deposits | 284.1 | (18.9) | (174.5) | (12.8) | 118.5 |

| Net interest expenses | (107.2) | (117.9) | (115.0) | (128.8) | (126.2) |

| Profit before tax | 1,877.5 | 1,398.5 | 1,526.0 | 2,352.6 | 1,739.8 |

| Tax expense | (341.1) | (282.2) | (396.0) | (583.7) | (323.5) |

| Profit for the financial year | 1,536.4 | 1,116.3 | 1,130.0 | 1,768.9 | 1,416.3 |

| Attributable to: | |||||

| Owners of the parent | 1,520.6 | 1,109.4 | 1,114.2 | 1,725.3 | 1,394.3 |

| Non-controlling interests | 15.8 | 6.9 | 15.8 | 43.6 | 22.0 |

| ASSETS | |||||

| Property, plant and equipment | 9,432.6 | 9,229.1 | 8,995.2 | 8,709.2 | 8,608.7 |

| Investments in associates | 3,245.8 | 3,103.3 | 3,013.3 | 3,110.0 | 3,144.5 |

| Other non-current assets | 661.9 | 625.2 | 647.1 | 669.2 | 564.7 |

| 13,340.3 | 12,957.6 | 12,655.6 | 12,488.4 | 12,317.9 | |

| Current assets | 4,763.2 | 4,984.6 | 4,926.3 | 6,679.4 | 5,337.8 |

| Assets classified as held for sale | 27.2 | - | - | - | - |

| 18,130.7 | 17,942.2 | 17,581.9 | 19,167.8 | 17,655.7 | |

| EQUITY AND LIABILITIES | |||||

| Total Shareholders’ Equity | 12,294.0 | 11,678.6 | 11,330.8 | 10,943.7 | 10,005.4 |

| Non-controlling interests | 338.8 | 331.1 | 339.8 | 340.8 | 309.0 |

| Total equity | 12,632.8 | 12,009.7 | 11,670.6 | 11,284.5 | 10,314.4 |

| Non-current liabilities | 3,847.3 | 4,351.7 | 4,235.8 | 4,131.7 | 2,303.7 |

| Current liabilities | 1,647.2 | 1,580.8 | 1,675.5 | 3,751.6 | 5,037.6 |

| Liabilities classified as held for sale | 3.4 | - | - | - | - |

| Total liabilities | 5,497.9 | 5,932.5 | 5,911.3 | 7,883.3 | 7,341.3 |

| 18,130.7 | 17,942.2 | 17,581.9 | 19,167.8 | 17,655.7 | |

| Net operating profit after tax (‘NOPAT’) | 1,642.6 | 1,238.0 | 1,243.5 | 1,889.9 | 1,541.6 |

| Average shareholders’ equity | 11,986.3 | 11,504.7 | 11,137.3 | 10,474.5 | 9,650.8 |

| Average capital employed1 | 17,153.1 | 16,927.7 | 17,178.3 | 17,062.6 | 16,178.7 |

| FINANCIAL STATISTICS | |||||

| Basic earnings per share (sen) | 24.51 | 17.88 | 17.95 | 27.74 | 22.26 |

| Dividend per share (sen) | 10.5 | 9.5 | 11.0 | 14.0 | 10.5 |

| Net assets per share (sen) | 198 | 188 | 183 | 176 | 160 |

| Return on average shareholders’ equity (%) | 12.69 | 9.64 | 10.00 | 16.47 | 14.45 |

| Return on average capital employed (%) | 9.58 | 7.31 | 7.24 | 11.08 | 9.53 |

| Net debt/Equity(%)2 | 13.69 | 13.55 | 13.99 | 22.80 | 29.37 |

| SHARE PERFORMANCE | |||||

| Market share price (RM): | |||||

| – Highest | 4.08 | 4.22 | 4.27 | 4.76 | 4.64 |

| – Lowest | 3.42 | 3.69 | 3.59 | 3.49 | 3.65 |

| – Closing | 3.74 | 3.70 | 3.73 | 3.84 | 3.76 |

| Shares trading volume (million) | 494 | 557 | 616 | 884 | 524 |

| Market capitalisation | 23,201.8 | 22,953.7 | 23,139.8 | 23,857.8 | 23,495.4 |

Notes:

1 Average capital employed comprises shareholders’ equity, non-controlling interests, long term liabilities, borrowings, lease liabilities and deferred tax.

2 Net debt represents total borrowings and lease liabilities less short term funds, deposits with financial institutions and cash and bank balances.

Contact Us

Mr Amir Mohd Hafiz bin Amir Khalid

Investor Relations

Level 28, IOI City Tower 2, Lebuh IRC,

IOI Resort City,

62502 Putrajaya, Malaysia.

| Tel: | (603) 8947 8888 |